Introduction:

For many financial and legal transactions in India, having your Permanent Account Number (PAN) at hand is crucial. However, it’s not uncommon to forget or misplace this important number. Fortunately, with advancements in digital services, finding your PAN number find has become easier, especially if it’s linked to your Aadhaar. This guide will help you with the process to “pan number find” using your Aadhaar number in 2024, ensuring you have quick access whenever needed.

What is a PAN Number?

A PAN, or Permanent Account Number, is a unique, 10-digit alphanumeric identifier issued by the Income Tax Department of India. It is used to track financial transactions, prevent tax evasion, and link all financial activities of an individual or entity. Whether you’re filing taxes, buying a vehicle, or opening a bank account, your PAN is indispensable.

PAN Number Finder

Why You Might Need to Your PAN Number find?

There are several scenarios where you might need to retrieve your PAN number:

- Filing Income Tax Returns: PAN is essential for filing your income tax returns.

- Banking Transactions: Banks require your PAN for transactions exceeding certain thresholds.

- Loan Applications: Financial institutions need your PAN for processing loans.

- Investments: To open a Demat account or invest in mutual funds, you need your PAN.

- High-Value Purchases: PAN is required for buying property, vehicles, or making large transactions.

How to Your PAN Number find Using Aadhaar in 2024?

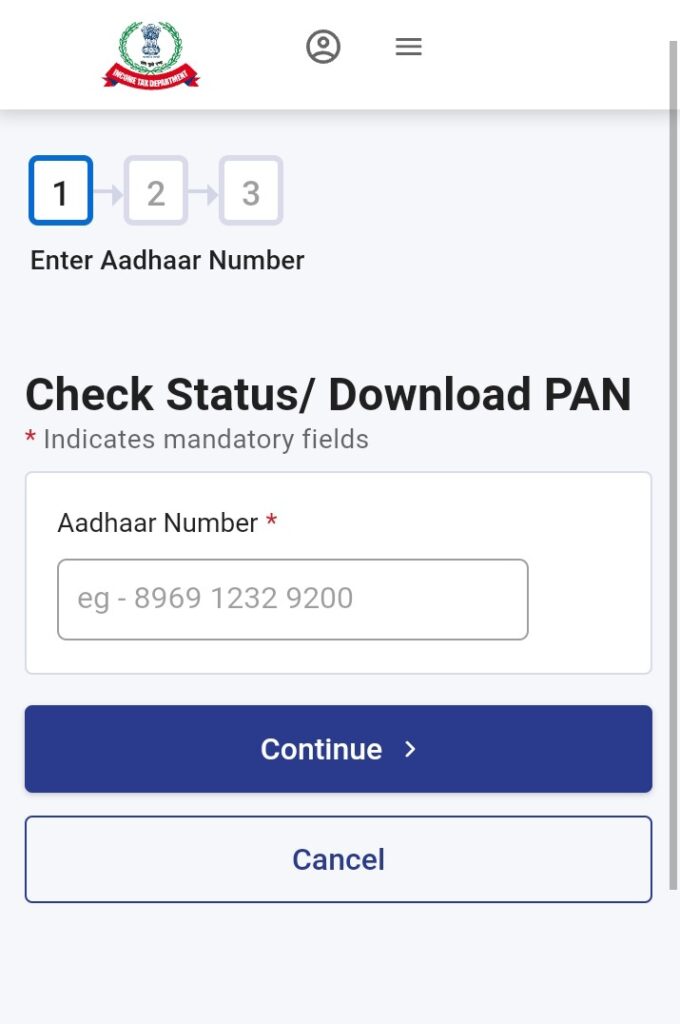

If your PAN is linked with your Aadhaar, retrieving your PAN number is straightforward. Here’s a step-by-step guide to help you with the “pan number find” process using your Aadhaar number:

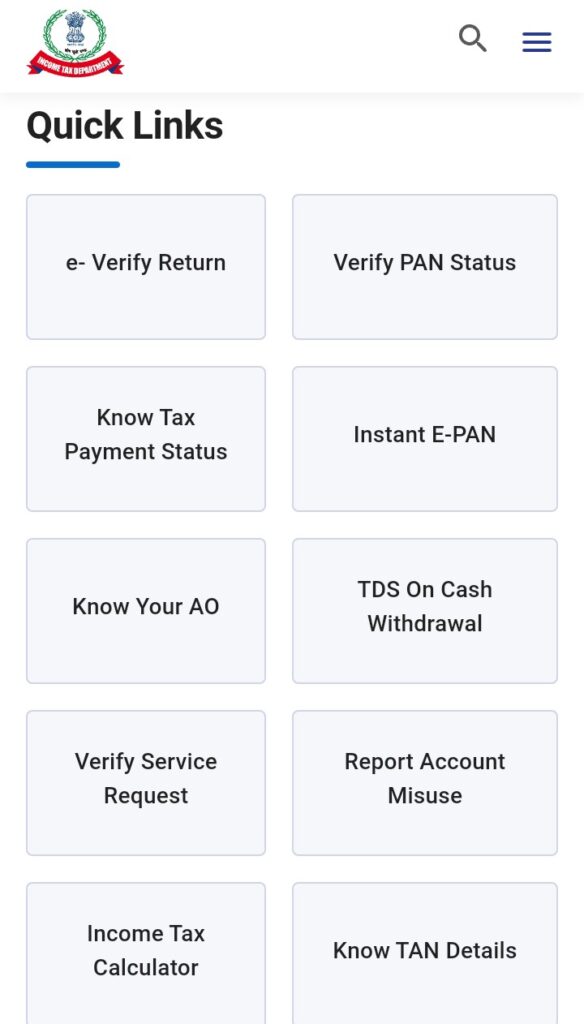

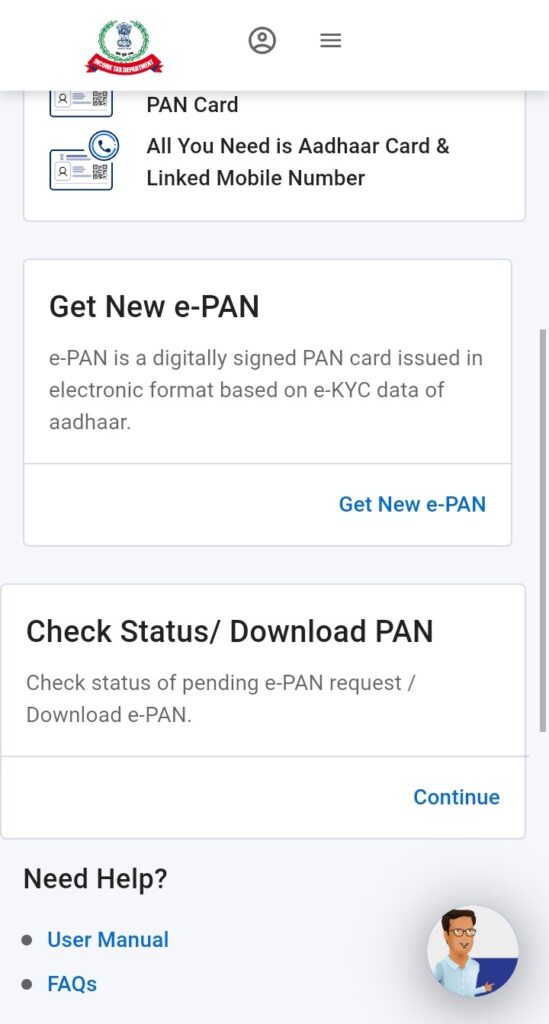

1. Using the Income Tax Department’s E-filing Portal:

The Income Tax Department’s official e-filing portal allows you to locate your PAN number using your Aadhaar.

- Step 1: Visit the official e-filing website at https://www.incometaxindiaefiling.gov.in.

- Step 2: Click on the ‘Know Your PAN’ option on the homepage.

- Step 3: Enter your Aadhaar number and other required details such as your full name and date of birth.

- Step 4: You will receive an OTP on your registered mobile number. Enter this OTP to proceed.

- Step 5: After verification, your PAN number will be displayed on the screen.

2. Using the UIDAI Website:

The UIDAI website, primarily for Aadhaar services, can also help your PAN number find if it’s linked.

- Step 1: Go to https://uidai.gov.in.

- Step 2: Go to the ‘Aadhaar Services’ area.

- Step 3: Select the service for PAN retrieval.

- Step 4: Enter your Aadhaar number and follow the instructions to view your PAN number. And pan number find easily.

3. Via SMS:

Retrieving your PAN number via SMS is also an option if your PAN is linked to Aadhaar.

- Step 1: Type an SMS in the format: UIDPAN<12-digit Aadhaar number><10-digit PAN>.

- Step 2: Send the SMS to 567678 or 56161.

- Step 3: You will receive an SMS with your PAN details.

4. Using the MyGov App:

The MyGov app is another convenient way to your PAN number find using Aadhaar.

- Step 1: Download and install the MyGov app from your app store.

- Step 2: Register and log in to the app.

- Step 3: Navigate to the section for linking Aadhaar with PAN or retrieving your PAN.

- Step 4: Follow the on-screen instructions to retrieve your PAN number.

What to Do If Your PAN is Not Linked to Aadhaar?

If your PAN is not linked to Aadhaar, you won’t be able to use the above methods. However, you can still retrieve your PAN through other means:

- Income Tax E-filing Portal: If registered, log in to the e-filing portal and view your PAN under ‘Profile Settings.’

- Bank Account: Check your bank’s net banking portal or visit the branch where you might have provided your PAN.

- Income Tax Helpline: Call the helpline at 1800 180 1961 for assistance in retrieving your PAN.

Linking PAN with Aadhaar:

To ensure that you can always find your PAN number using Aadhaar in the future, it’s essential to link the two. Here’s how:

- Step 1: Visit the Income Tax e-filing portal.

- Step 2: Click on ‘Link Aadhaar’ on the homepage.

- Step 3: Enter your PAN, Aadhaar number, and name as per Aadhaar.

- Step 4: Verify the details and submit the form.

- Step 5: Once verified, your PAN will be linked with Aadhaar.

Securing Your PAN and Aadhaar:

Your PAN and Aadhaar are critical identifiers. Here are a few suggestions to help you keep them safe:

- Limit Sharing: Only share your PAN and Aadhaar with trusted entities.

- Beware of Scams: Avoid responding to unsolicited calls or emails asking for your PAN or Aadhaar details.

- Regular Monitoring: Regularly check your financial statements to ensure there’s no unauthorized use of your PAN or Aadhaar.

Conclusion:

Finding your PAN number doesn’t have to be a hassle, especially when using your Aadhaar number. With the steps outlined in this guide for “pan number find,” you can easily retrieve your PAN in 2024. By keeping your PAN linked to your Aadhaar and following the security tips provided, you can ensure that you always have access to your PAN number when needed. For more helpful tips and updates, stay tuned to our blog!